7 Surprising Housing Market Trends That Could Skyrocket Your Investment Returns

Investors who stay alert to new shifts in the housing market often reap the biggest rewards. In 2025, there are a number of housing market trends that many people are overlooking—but these can be game‑changers for property investors. From interest rates easing, to remote work reshaping demand, to sustainability becoming a must, understanding these trends could mean transforming modest investments into high‑return assets. Below are seven surprising housing market trends that could skyrocket your investment returns, along with tips for leveraging them effectively.

1. Declining Mortgage Rates and the Timing Window

One of the most critical housing market trends to watch is the gradual drop in mortgage rates. After a period of high interest rates that severely dampened affordability, analysts expect rates to begin easing toward more favorable levels. Lower rates reduce monthly payments and make financing large investments more doable.

According to recent forecasts, falling rates could unlock pent‑up demand from buyers waiting on the sidelines. As financing becomes less of a burden, buyers will be more willing to invest in rental properties, fix‑and‑flip projects, and high‑quality long‑term holdings. For investors, locking in properties before rates drop further may lead to steep appreciation and strong cash flows.

2. Persistent Supply Shortages Combined with Investor Hesitance

Another surprising dynamic is the combination of limited supply and cautious investor behavior. Housing inventory remains well below long‑term norms in many markets. Builders are constrained by high input costs, regulatory hurdles, and labor shortages. Meanwhile, many existing homeowners are locked into low mortgage rates and are reluctant to move, further constricting supply. :contentReference[oaicite:0]{index=0}

When supply is tight while demand remains solid, prices tend to rise. For investors, this environment favors high‑quality properties in high‑demand areas. Even modest improvements or rentals in undersupplied regions may outperform larger projects in saturated zones.

3. Millennials, Gen Z, and Changing Buyer Demographics

Demographic shifts are among the most powerful of all the housing market trends. Millennials and older Gen Z are entering or expanding in their home‑buying years. They’re looking for homes with work zones, better energy efficiency, and more space, especially in suburban or exurban areas. :contentReference[oaicite:1]{index=1}

This change is driving up demand in areas that were previously undervalued, such as suburban nodes that offer good internet, amenities, and commute options. Investors who recognize these demographic shifts early can acquire undervalued properties and benefit from both appreciation and rental demand.

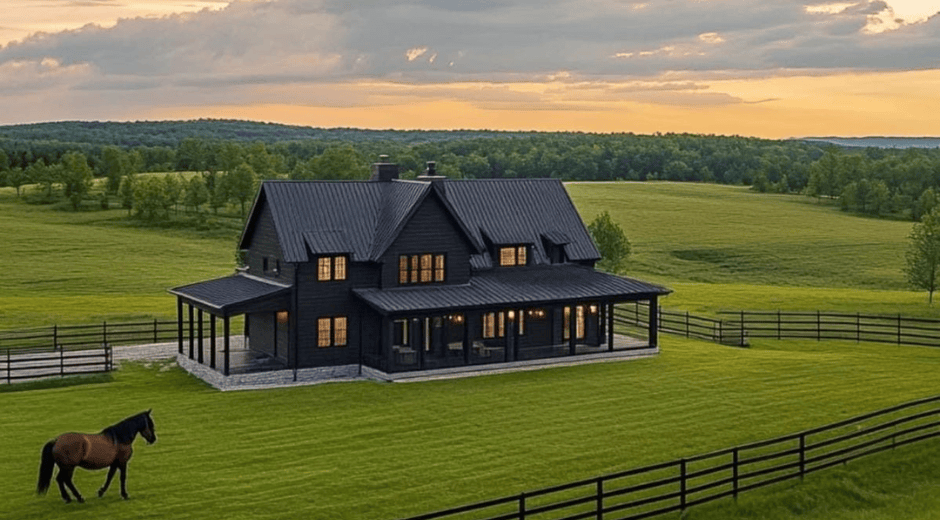

4. Remote Work and Geographic Shifts in Demand

Remote work remains one of the surprise factors altering how, where, and what people buy when it comes to real estate. As fewer people need to commute to city centers, demand is growing in suburban, rural, and even smaller city markets. Homes that offer spacious interiors, outdoor amenities, and work‑friendly zones are gaining popularity. :contentReference[oaicite:2]{index=2}

For investors, this means markets that once seemed secondary are now primary contenders. Buying in up‑and‑coming suburbs or towns with strong quality of life metrics (schools, healthcare, connectivity) may yield significant return as demand shifts outward.

5. Green, Sustainable, and Smart Homes Are No Longer Optional

Sustainability is evolving from a "nice‑to‑have" to a requirement in many markets. Buyers and renters are increasingly demanding sustainable features such as solar panels, high efficiency HVAC systems, green building materials, and smart home tech. These features not only reduce operating costs but often enable premium pricing. :contentReference[oaicite:3]{index=3}

Properties with energy certifications, low utility bills, and environmental credentials tend to attract both premium tenants and buyers willing to pay more upfront. For investors, integrating sustainable upgrades can drastically improve net yields while increasing resale value.

6. Accessory Dwelling Units (ADUs) & Alternative Housing Solutions

ADUs, modular homes, prefab units, and other alternative forms of housing are gaining ground as a surprising but powerful trend. They offer both supply relief and high ROI when done correctly. ADUs allow owners to generate rental income from existing properties without needing to buy new ones. Modular and prefab construction can reduce construction costs and delivery time. :contentReference[oaicite:4]{index=4}

For investors, deploying ADUs or buying modular‑built units can be a way to scale holdings faster and with lower cost and risk—especially in markets with high construction costs or slow permitting.

7. Housing Policy, Regulation & Tax Shifts That Provide Leverage

Often underestimated among the housing market trends are shifts in policy—changes to property taxes, zoning, permits, rent control, and incentives for affordable or sustainable housing. These changes can rapidly alter profitability or risk in certain markets.

For example, markets offering tax credits for green upgrades, streamlined permitting for accessory units, or incentives for affordable housing might attract developers and investors looking for higher returns. On the flip side, regulatory headwinds in luxury zones or areas with strict rent control could dampen returns for some properties.

Putting It All Together: Strategy for Investors

So, what can an investor do to take advantage of these 7 surprising housing market trends and truly skyrocket returns? Here are some actionable steps:

- **Identify high growth‑potential suburbs or secondary cities**: Look for places with growing employment, good amenities, and connectivity.

- **Focus on properties with sustainable features**: Energy efficiency, solar, good insulation. These reduce running costs and appeal to tenants/buyers.

- **Evaluate alternative housing types**: ADUs, modular homes, etc., can offer high yield.

- **Monitor mortgage rates closely**: Getting in when rates are favorable can make a big difference in both cash flow and resale.

- **Stay alert for policy changes**: Local tax, zoning, and regulation shifts can exponentially affect returns.

- **Diversify your investment types**: Mix rental properties, flipping, sustainable builds, etc., to balance risk.

Internal Resources for Further Insight

For a deeper dive into applying these trends in your market, check our Housing Market Trends Playbook, where we explore region‑by‑region forecasts, sustainable upgrade case studies, and financing options.

External Sources & References

- Forbes – Real estate expert commentary, financing, and trend analysis

- Architectural Digest – Design, building materials, and sustainability in luxury homes

- Houzz – Housing style, unit types (ADUs), and renovation inspiration

Markets Made Easy

Contemporary Apartment Style Made Practical

Contemporary Apartment Style Made Practical