Property Forecasts: What Experts See for 2025 Housing Market

Property Forecasts: What Experts See for 2025 Housing Market

The real estate landscape continues to evolve with new technologies, shifting demographics, and global economic adjustments. As we move into 2025, understanding how these forces shape the Property market becomes essential for both homeowners and investors. Analysts agree that the coming year will mark a new phase of transformation—one defined by smarter investments, sustainable construction, and adaptable urban planning.

The housing sector’s performance depends not only on buyer demand but also on interest rates, government policies, and global capital flows. Let’s explore what experts forecast for the upcoming Property trends, where opportunities are likely to emerge, and how investors can prepare for a dynamic market cycle.

The Global Pulse of Property in 2025

Across the world, real estate continues to act as a barometer for economic health. According to analysts from Business Forum Hub, 2025 will witness moderate but steady growth in most developed regions, driven by renewed confidence and increased migration to suburban and hybrid communities.

In major cities, supply shortages remain a challenge. Despite higher interest rates in recent years, the need for housing—particularly affordable units—has outpaced construction. The Property sector’s resilience lies in its adaptability: where urban cores tighten, suburban and secondary markets flourish.

Emerging markets are also expected to gain attention. Infrastructure expansion, combined with digital connectivity and environmental planning, will make once-overlooked regions appealing to developers. Investors who identify early growth corridors may secure strong long-term returns.

Rising Influence of Technology on Property Markets

Smart technology is no longer a futuristic promise—it’s shaping how buyers evaluate, manage, and invest in real estate. Artificial intelligence, predictive data models, and digital property management tools streamline decisions for both homeowners and large investors.

As Finance World Hub reports, automation now plays a key role in predicting Property valuations, detecting risk, and improving transparency. Blockchain-based transactions, for instance, could make title transfers faster and safer, while virtual reality platforms help buyers explore properties remotely.

This digital transformation makes 2025 an exciting year for real estate innovation. Markets that embrace technology will likely see higher efficiency and investor confidence. The Property sector’s next leap forward lies in how effectively it merges technology with human insight.

Sustainability as a Market Driver

One of the most significant themes for 2025 is sustainability. Green building certifications, renewable materials, and carbon-conscious architecture are no longer niche; they are mainstream Property expectations. Governments and consumers alike are pushing for energy-efficient designs, not only for environmental reasons but also for long-term cost savings.

Developers who align with sustainability trends stand to benefit from tax incentives, stronger brand reputation, and faster sales. Moreover, environmentally responsible properties maintain higher value over time, reducing depreciation risks.

This shift also redefines investor strategies. Rather than focusing solely on short-term profit, many funds are now investing in Property developments that meet ESG (Environmental, Social, and Governance) standards—a model that promotes both ethical and financial growth.

Affordability Challenges and Shifting Buyer Behavior

Affordability remains a key concern in many global markets. Rising land and construction costs continue to limit access to ownership, particularly for first-time buyers. However, new housing models are emerging to address this challenge.

Experts predict increased interest in co-living arrangements, modular housing, and adaptive reuse projects—where older commercial buildings are converted into residential spaces. These approaches make the Property market more inclusive and efficient, offering flexibility without sacrificing comfort.

Meanwhile, younger generations prioritize mobility and experience over ownership. This behavioral shift reshapes how the Property sector defines success—not just through sales volume, but through service-based models such as rental platforms and community-driven developments.

Interest Rates and Market Stability

Economic indicators suggest that global interest rates will stabilize throughout 2025, providing cautious optimism for borrowers and developers alike. After years of fluctuation, predictability will encourage long-term planning in the Property sector.

However, stability doesn’t eliminate risk. Investors must remain alert to regional variations and policy changes. Some markets may continue tightening credit to control inflation, while others will stimulate demand through subsidies or relaxed mortgage rules.

The connection between monetary policy and Property performance will remain strong, meaning successful investors must blend economic awareness with local insight.

Regional Trends to Watch

1. North America

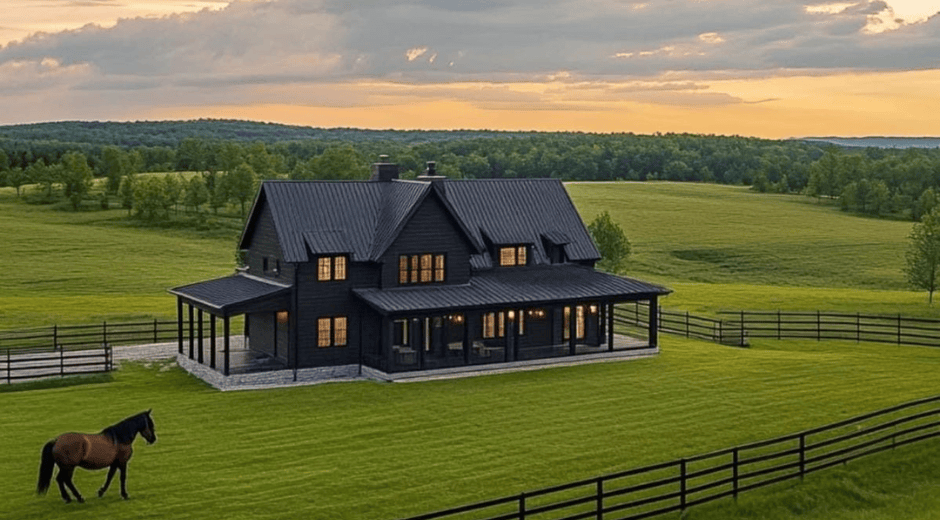

Suburban expansion continues as remote work reshapes living preferences. Expect an increase in sustainable townships and mid-tier housing that balances affordability with accessibility.

2. Europe

Cultural heritage meets modern technology. Adaptive reuse of historic buildings—converting old factories or schools into residences—will dominate the Property conversation in key urban centers.

3. Asia-Pacific

Rapid urbanization drives vertical growth, while green infrastructure projects redefine city planning. Coastal regions focus on climate resilience and smart-energy systems.

4. Middle East and Africa

Strategic investments in renewable energy and tourism-driven Property sectors fuel new urban economies. Luxury eco-communities are emerging as regional growth icons.

Investment Opportunities and Strategic Insights

The best investors know that forecasting is about preparation, not prediction. In 2025, success in Property investment will depend on reading data-driven signals and balancing short-term liquidity with long-term vision.

Sectors such as senior living, co-working spaces, and sustainable housing projects show strong upward potential. Diversification will continue to be the golden rule—spreading capital across geographies and asset types reduces risk while maintaining growth.

Platforms like MetroPropertyHomes provide valuable insights into real-time design and market dynamics, helping both professionals and homeowners understand where to position their investments.

As market volatility decreases, investors are expected to shift focus from speculative trading to value creation—prioritizing developments that serve social and environmental needs alongside profit.

Economic Ripple Effects

The Property market influences every other economic sector—from manufacturing and retail to energy and infrastructure. Stable growth here translates into stronger national economies.

As Business Forum Hub highlights, government incentives, smart regulation, and cross-sector partnerships will determine how resilient housing systems remain during future disruptions. A balanced approach—one that integrates innovation, policy, and affordability—will sustain economic vitality.

In short, the 2025 Property forecast reflects a world learning from past volatility and aiming for smarter equilibrium.

Conclusion

2025 promises to be a defining year for real estate. With technology advancing, sustainability rising, and markets stabilizing, the Property sector stands at a pivotal moment. Those who adapt early—by embracing digital solutions, green design, and long-term strategies—will thrive.

Investors and homeowners alike must remember that every forecast is a guide, not a guarantee. The key lies in adaptability, continuous learning, and making informed choices grounded in evidence.

The future of Property isn’t just about buildings; it’s about building resilience.

Easy steps to Luxury

Contemporary Apartment Style Made Practical

Contemporary Apartment Style Made Practical

Modern Home Refresh Without Renovation

Modern Home Refresh Without Renovation