Why Some Homes Appreciate Faster: Hidden Variables

Why Some Homes Appreciate Faster: Hidden Variables

Real estate appreciation is often discussed as if it follows predictable patterns, yet homeowners and investors quickly learn that two similar properties can behave very differently over time. Some houses seem to gain value steadily and reliably, while others remain flat for years. Understanding why certain homes appreciate faster requires examining not just the property itself, but the larger context surrounding it. Appreciation is shaped by economics, population behavior, neighborhood conditions, property characteristics, and subtle psychological influences that go beyond standard price-per-square-foot calculations.

The question of why value increases at different rates is especially important in a shifting market. Buyers want security, sellers want leverage, and investors look for strategic long-term growth. A house is not only a place to live; it is a financial asset, and its performance reflects how well it fits into developing social and market trends. To make informed decisions, it is necessary to analyze the variables that determine long-term stability, desirability, and perceived worth

Location, But More Specifically: Micro-Location

The classic saying that location determines price still holds true, but to understand why appreciation differs, we need to look deeper than just city or region. Micro-location refers to the specifics of where exactly the property sits within a neighborhood. Two homes in the same town may have entirely different trajectories depending on proximity to schools, transit lines, noise sources, parks, or future development plans.

For example, homes near newly improving commercial corridors often benefit from increased walkability and convenience. Conversely, houses near heavy traffic or industrial activity may appreciate slowly. The subtle details of surrounding infrastructure influence perceived livability, which is a primary reason why appreciation can diverge over time.

Neighborhood Image and Reputation

A neighborhood’s identity is a powerful driver of appreciation. The way residents, visitors, and potential buyers feel about an area affects long-term demand. Community events, local culture, visible upkeep, and public investment all shape reputation. These factors influence why a property in one neighborhood rises in value while a similar property elsewhere stagnates.

Access to local viewpoints and trends can be researched in digital archives and newspapers, which show how neighborhoods evolve culturally and socially. Websites such as https://newspapersio.com/ can offer glimpses into the changing character of an area through past reporting, commentary, and historical reference.

Architectural Quality and Design Continuity

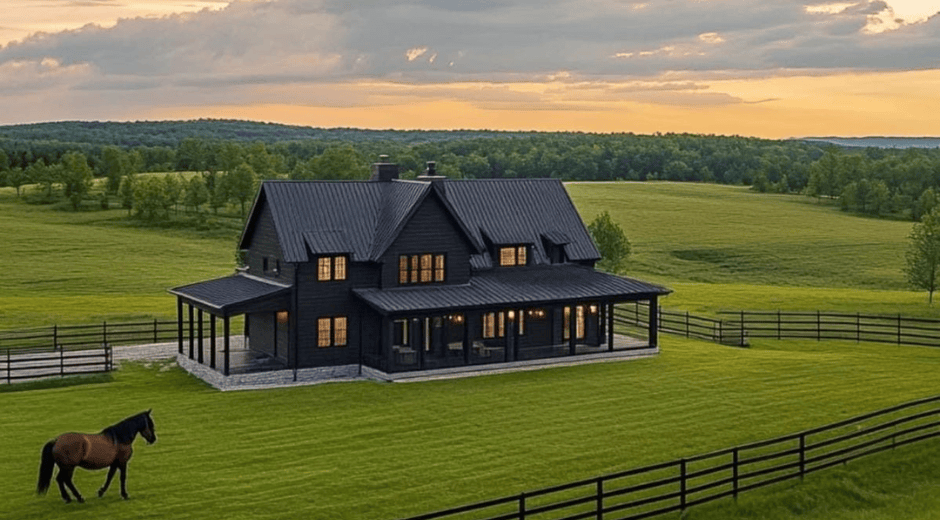

Not all houses are built with the same attention to materials, structural integrity, or design detail. A home with high-quality craftsmanship and timeless layout tends to appreciate more reliably. This is one reason why some properties hold value even when markets slow.

Design also affects emotional response. A home that feels open, comfortable, and visually consistent with modern living patterns is naturally more desirable. Upgrades must enhance function rather than simply add decoration. Even small changes can create noticeable value shifts when done thoughtfully.

For inspiration in design planning or interior updating, browsing accessible furnishing collections and layout solutions can be helpful. For example, sites like https://www.ikea.com/ provide ideas for improving storage, flow, and comfort in ways that appeal to a wide range of future buyers.

Local Economic Growth and Infrastructure Development

Economic development influences why properties appreciate differently. When new businesses open, job access increases and housing demand rises. Infrastructure investments such as transit expansion, public transportation improvements, and road upgrades can significantly improve desirability.

Conversely, regions experiencing declining employment opportunities often see stagnant values. What drives property appreciation is not just economic strength in the present, but confidence that the region will remain appealing in the years to come.

Demographic Demand Patterns

Population changes have a direct impact on housing appreciation. For instance, an increase in younger professionals can bring interest in walkable neighborhoods with mixed-use amenities. A rising retiree population may drive demand for quiet communities with comfortable layouts. Understanding why certain demographic groups choose certain areas can help predict future appreciation.

Shifts in family size, work-from-home trends, and commuting expectations each contribute to how neighborhoods transform over time. Homes that match evolving lifestyle preferences appreciate faster because they meet real needs rather than temporary trends.

Renovation Quality and Long-Term Maintenance

Renovations do not automatically translate into value growth. The why behind appreciation here has to do with purpose and precision. Improvements that enhance function, durability, and comfort tend to add long-term value. Trend-dependent remodels that focus on temporary visual style often age quickly.

Maintenance also matters: a well-cared-for property signals reliability. Buyers interpret a clean, structurally sound home as a lower-risk investment, which supports stronger appreciation.

For further planning resources, homeowners can explore more thoughtful guides and market insights at https://metropropertyhomes.com, which offers structured understanding of how property strategy can shape financial outcomes.

Buyer Psychology and Emotional Connection

Ultimately, the human element explains why property value does not follow purely mathematical logic. Buyers are guided by intuition as much as by data. A house that feels inviting, balanced, and reflective of personal identity is more appealing, which increases competition among buyers. Competition drives price growth.

Homes that create emotional resonance appreciate faster because more people see them as a place they can imagine living well, not just a building with rooms.

Conclusion

Real estate appreciation is shaped by many variables operating together. Understanding why some homes grow in value faster requires looking beyond surface-level factors. Micro-location influences convenience and comfort. Neighborhood identity builds trust and desirability. Construction quality provides durability. Economic growth and demographic patterns drive demand. Renovation and maintenance shape long-term perception. Emotional connection shapes buyer competition.

When these elements align, appreciation is not accidental but the natural result of a property that fits the evolving expectations of the market. By learning why value changes, both homeowners and investors can make clearer, more strategic decisions that support stable financial outcomes.

Easy steps to Luxury

Contemporary Apartment Style Made Practical

Contemporary Apartment Style Made Practical

Modern Home Refresh Without Renovation

Modern Home Refresh Without Renovation